Loading

Loading

case

case

study

study

2022

8 weeks

Product design

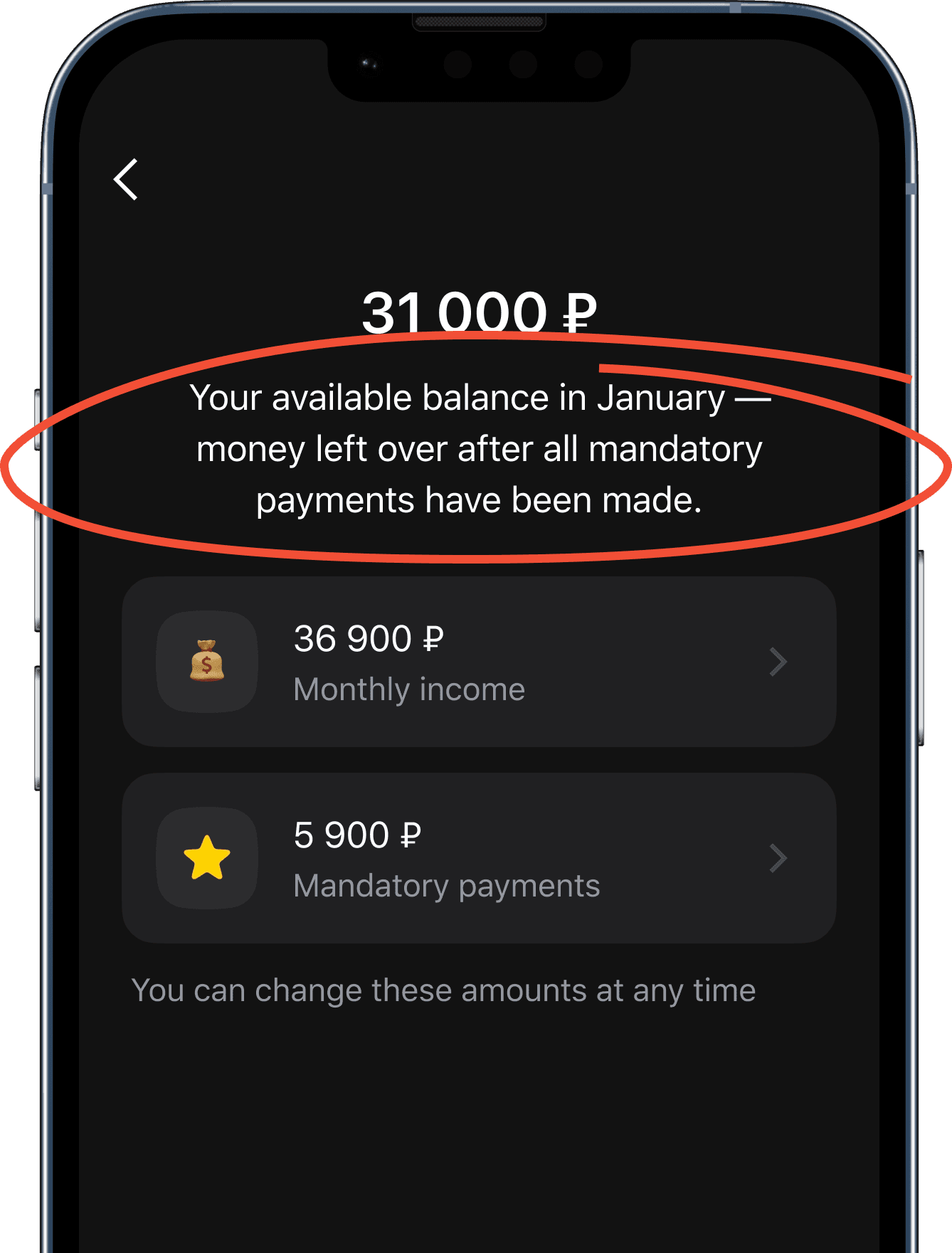

The financial assistant helps clients understand how much money they can spend right now, so that at the end of the month they do not go into a negative balance or remain in a positive balance.

Business goal

Increase sales. It was assumed that if customers returned to the banking application more often, this would have a positive effect on the purchase of other bank products.

Success metric: 10-15% 7-day retention from activated users.

My task and role

As a product designer, I had to design the IA, prepare mockups and validate the solution.

Context

I joined the project at a late stage. Alexander Volkov and Sergey Gorbachov (product managers of Alpha-Bank Growth-department) have already conducted a JTBD-research, identifying the main job for which users hire a mobile bank with the ability to plan a budget and validated the hypothesis on a simple MVP.

At that time, the bank’s mobile application provided only expense analytics by category, without answering the question about the client’s financial health and capabilities. The PFA was supposed to fix it by creating a competitive advantage over other country's leading banks.

Discovery

Questions to answer

How do people plan their expenses and savings?

What difficulties do they face?

What questions do they have and in what context?

What I did

Analyzed insights from the JTBD-research.

Together with the team, I formulated the main job stories. This allowed us to better understand the context and goals of users.

Conducted an analysis of similar tools for budget management.

Job the mobile banking is hired for:

Key insights

People are tired of manually tracking expenses and want a fully automated solution. Special applications have no access to transactions, and the mobile bank only provides expense analytics by category.

People are mainly concerned not with where the money is going, but with what can be done to fix the situation.

People unclear about how much they can save without losing their quality of life.

A typical budgeting algorithm looks like: 1) mandatory payments > 2) life goal > 3) “just in case” buffer > 4) planned purchases > 5) everyday expenses.

People want to make a purchasing decision on the go: “Can I afford this purchase right now?”

How might we help clients make purchasing decisions on the go and not only to break even but to get a profit at the end of the month?

Job stories

I created a set of job stories that helped us better understand the context of the user’s tasks and build the information architecture of the application. Here are just some of them:

When I make a purchase, I want to know how much money I can spend today/this month to make a profit by the end of the month.

When I review my finances, I want to make sure I'm sticking to my budget to make a profit by the end of the month.

When I go over my budget, I want to analyze where the money is going so I can decide where I can cut costs.

When I create a budget, I want to take into account regular and scheduled payments so that as a result of everyday expenses, I do not use up this money.

Ideation

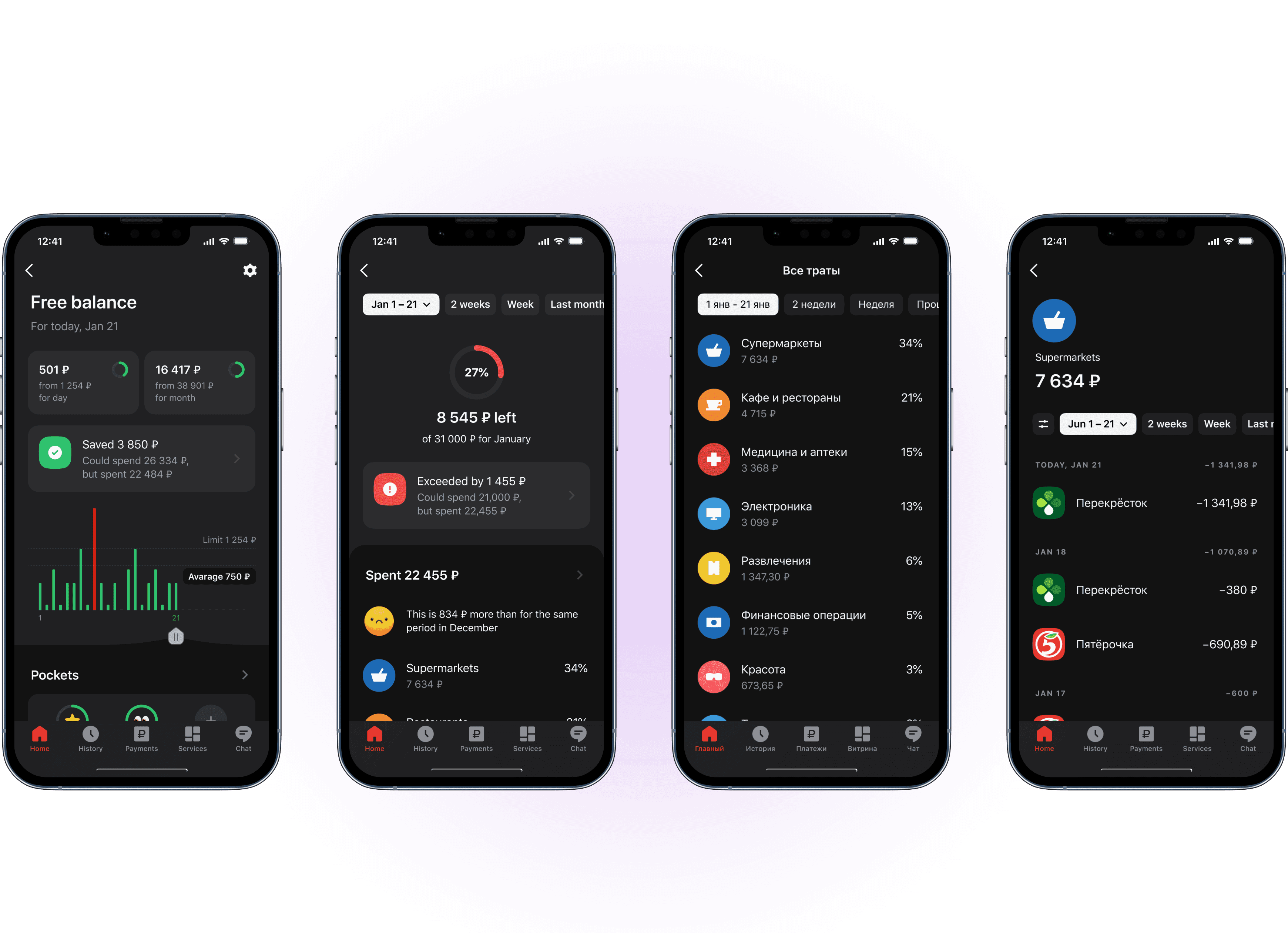

Custom limits

When making purchase decisions, the client checks not only the balance for the day, but also the balance according to the custom limits. For instance, a client may have $100 left for today, but he can't go to McDonald’s, since he has already exceeded the monthly limit for this merchant.

Set a limit for an individual merchant or for an entire category? A report on expenses for the entire month helps with this.

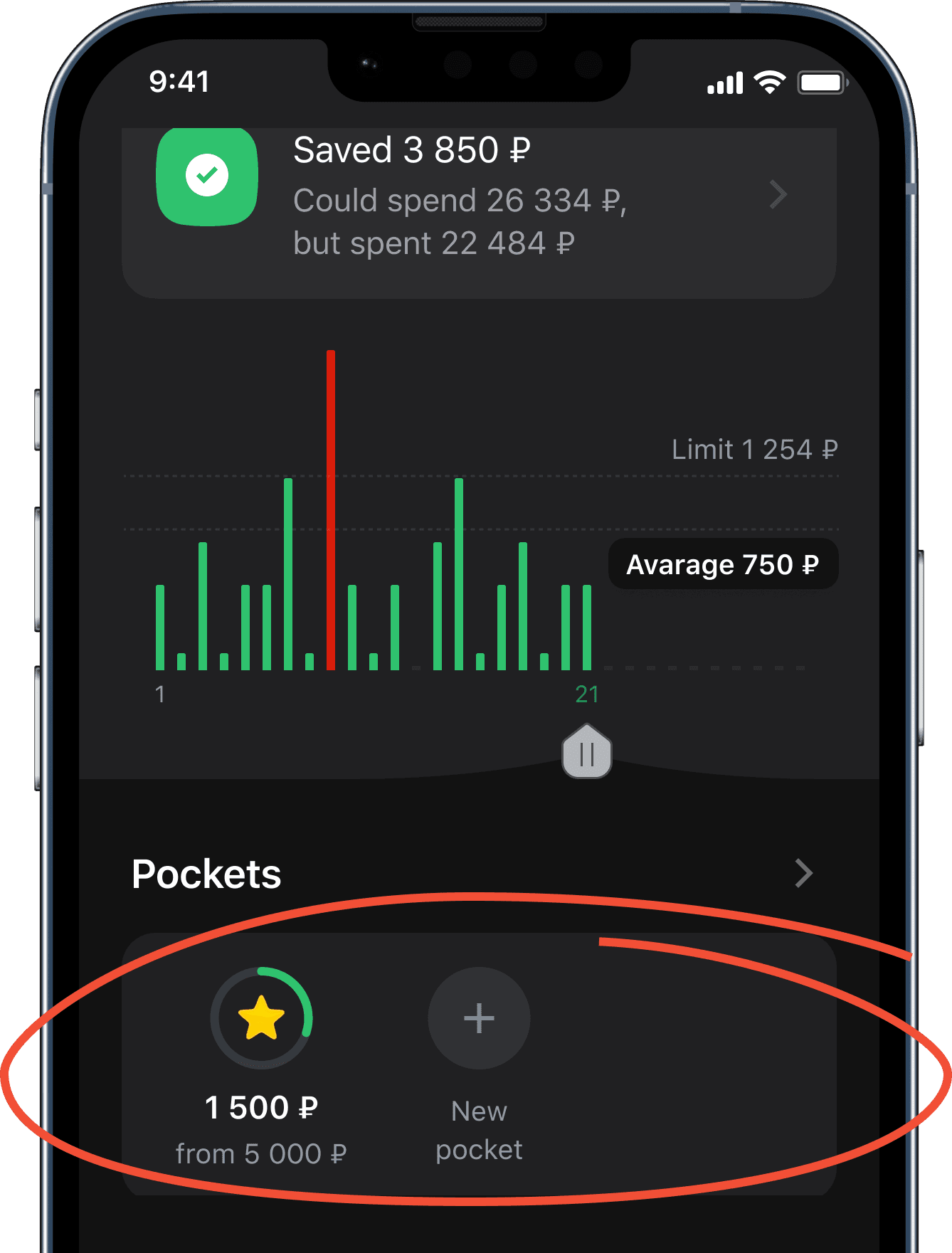

Spending graph

The graph clearly demonstrates on which days the client exceeded the daily limit. This allows clients to track overspending trends and adjust expenses in the future.

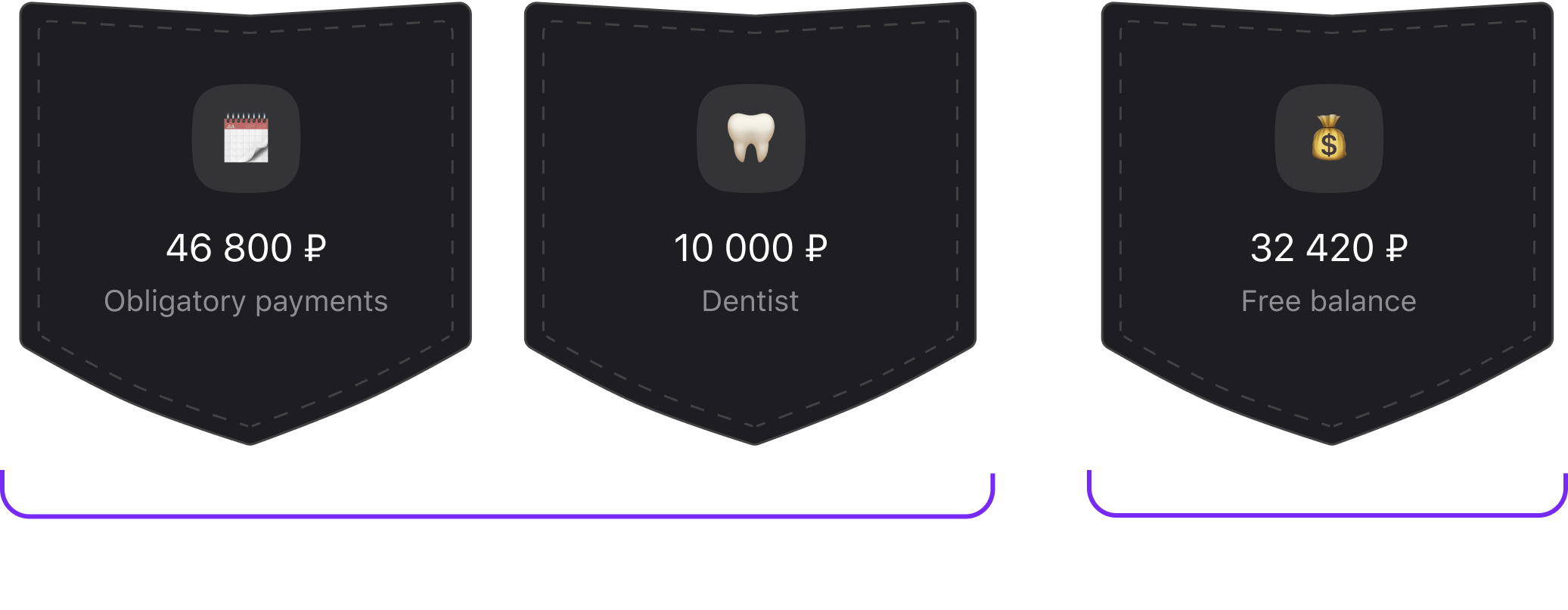

Pockets concept

Sometimes we need to reserve some amount for certain expenses, for example, going to the dentist or buying new furniture. In this case, we can put aside part of the free balance in another “pocket”.

As you can already guess, Free Balance and Mandatory Payments are also pockets. In the interface, we detail the pocket with the Free balance, since this is exactly what needs to be controlled during daily expenses.

Let's see what the assistant interface looks like immediately after the initial setup and how a new pocket is created. I'm using round numbers to make it easier for you to understand the changes.

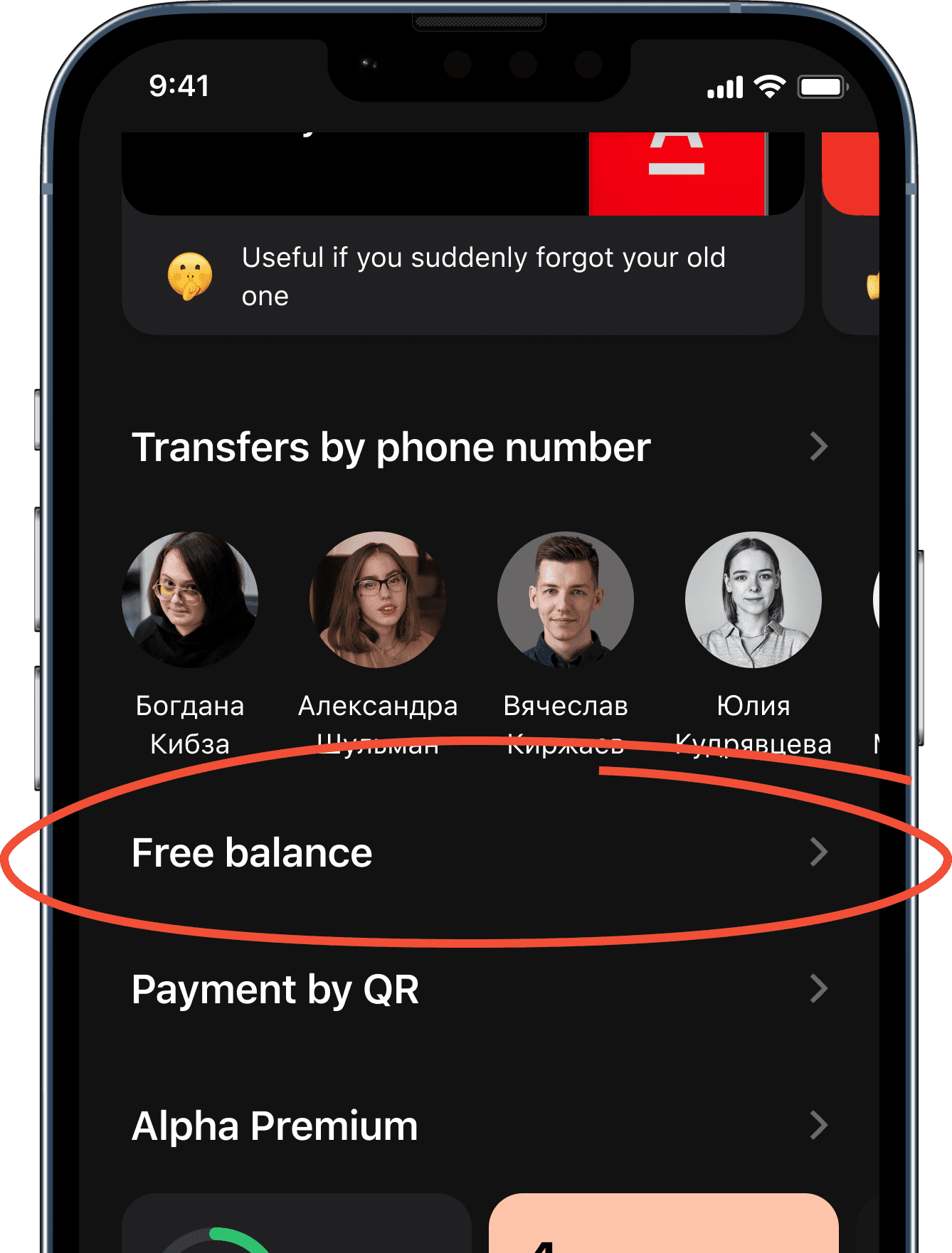

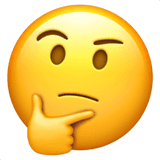

Entry point

Free balance is a functionality of the Alfa Bank mobile application. To go to the free balance, a bank client can use the link on the main screen.

Validation #1

Remote moderated usability testing of the Alfa-Bank mobile application was conducted (via Zoom, on a smartphone). Respondents were asked to familiarize themselves with the new “Free balance” section, describe its purpose, create a budget and add a new pocket.

There are only 10 people (mass segment) who regularly receive their salaries into an account in Alfa Bank and analyze their expenses.

Initial setup

60% completion

Understanding the purpose

60% completion

Creating a pocket

10% completion

The first difficulties arose where we expected them. Due to the complex process of reconciling content on the home screen, we decided to test the minimum possible entry point option — a text link. Respondents had great difficulty finding it (especially because we avoided directly mentioning “Free balance,” as is expected when testing interfaces).

When I think about how much money I can spend, I am sure that this information should be somewhere near the balance in my accounts.

And here is another feedback that was left at the final stage of the test:

I would like to see the answer to the question "can I make this purchase" as quickly as possible, since I do it directly in the store and do not have much time to search within the application

Well, now we have an strong argument to get more space on the main screen.

Despite the fact that respondents understood the origin of the numbers during the initial setup, they had difficulty understanding why this might be needed and for what purposes.

Most respondents had serious difficulties understanding the purpose of pockets. Only 1 of them was able to almost accurately determine their purpose and create a new pocket.

Well, how might we make it more discoverable and easier to understand?

Ideation #2

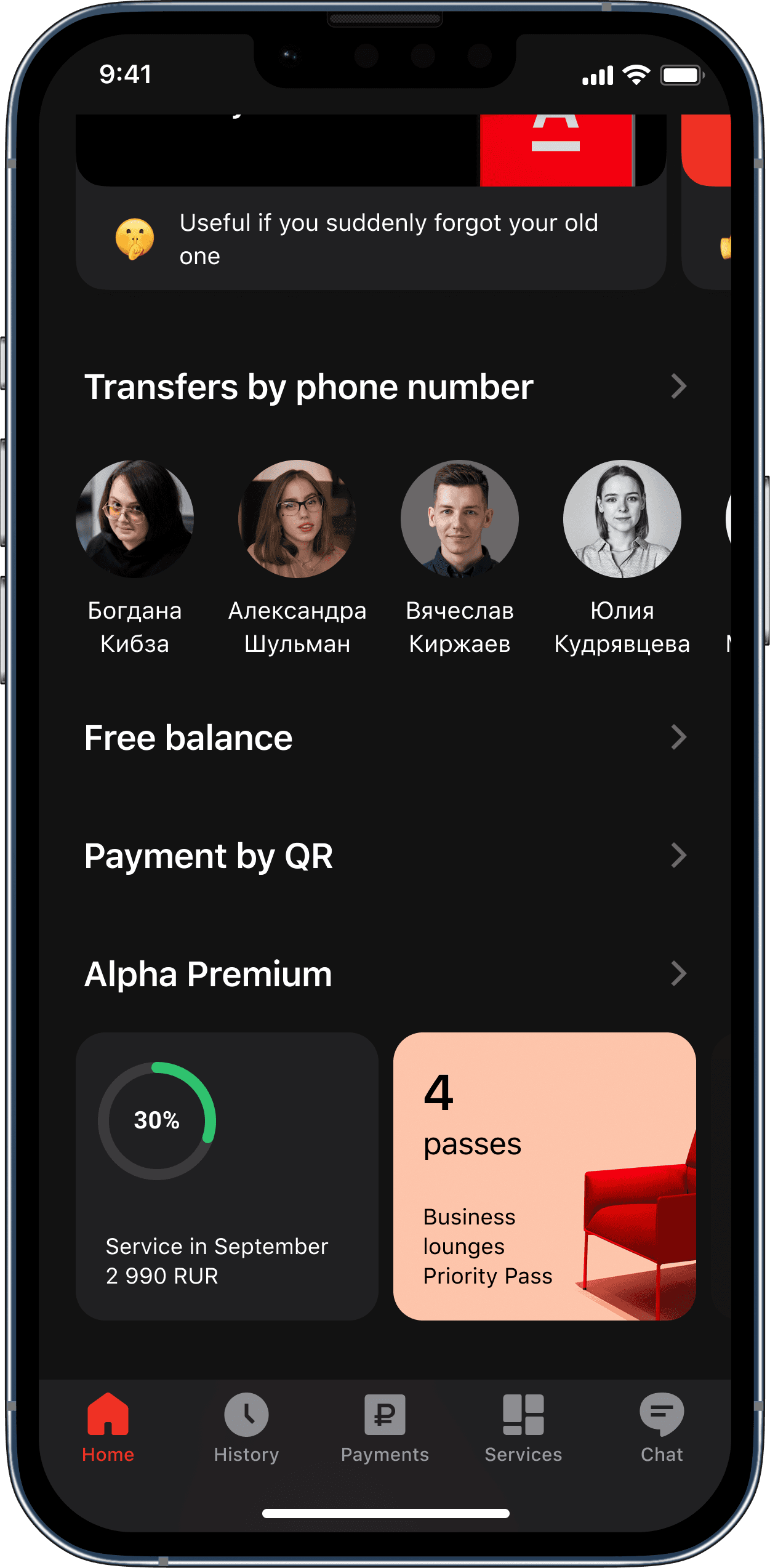

Text link → Widget

First of all, we decided that the Free Balance screen is well suited for scenarios where analytics and action from the user are required. While making decisions on the go, it's important to see the available money already on the first screen.

The widget answers the main question: “How much money can I spend right now?” We placed it at the very top, under promotional offers, as it important to know the available amount before making any financial transactions.

Before

After

Limits are also in sight

The client may have enough money for today, but the limit for a certain merchant has already been reached or even exceeded. This is why limit balances are just as important for quick decisions as balances.

Budget status

The widget makes it clear if something is wrong with the budget. This creates a trigger for the user to make adjustments.

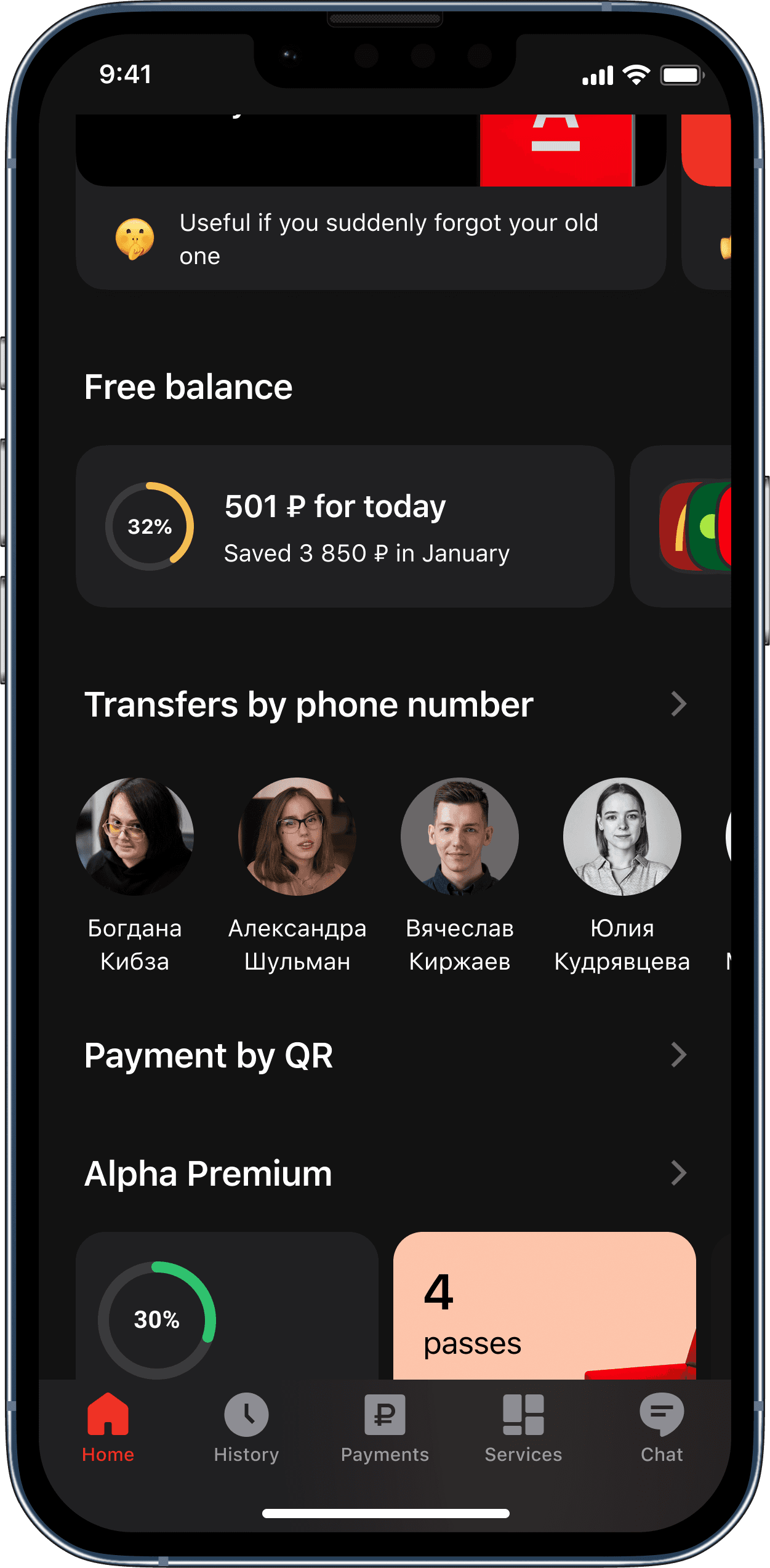

Welcome screen

The purpose of this screen is to convey an idea in simple words.

Tips about pockets

The part with the pockets was the most difficult in the first testing. Perhaps this is exactly the place where the user should be trained.

Validation #2

Initial setup

100% completion

Understanding the purpose

100% completion

Creating a pocket

80% completion

Conclusion

We were quite satisfied with the results obtained. MVP showed that people figure it out pretty quickly when they see real numbers based on their income and expenses (something we couldn't achieve with the prototypes). Mockups for all iterations and specifications for new components were prepared and handed over to the developers.

Unfortunately, I stopped working at Alfa-Bank even before the release. The feature is currently released on Android devices and is being developed for iOS.